Latest RBI Bank Rates in Indian Banking - 2019

Repo price additionally known as the benchmark hobby rate is the charge at which the RBI lends money to the banks for a short time period. When the repo price increases, borrowing from RBI becomes greater high priced. If RBI desires to make it more pricey for the banks to borrow cash, it will increase the repo charge similarly, if it wants to make it inexpensive for banks to borrow cash it reduces the repo price. Current repo charge is 6.25%

Reverse Repo rate is the quick time period borrowing price at which RBI borrows cash from banks. The Reserve bank uses this tool whilst it feels there is too much cash floating within the banking machine. An growth within the reverse repo rate manner that the banks gets a better price of interest from RBI. As a result, banks prefer to lend their cash to RBI that's constantly safe in place of lending it others (people, groups and many others) that's continually risky.

Repo Rate signifies the rate at which liquidity is injected within the banking system via RBI, whereas Reverse Repo price signifies the price at which the central bank absorbs liquidity from the banks.

CRR - Cash Reserve Ratio - Banks in India are required to maintain a certain percentage of their deposits in the form of cash. However Banks do not preserve these as cash with themselves, they deposit such coins(aka currency chests) with Reserve Bank of India , which is considered as equal to retaining coins with themselves. This minimal ratio (that is the a part of the full deposits to be held as coins) is stipulated with the aid of the RBI and is known as the CRR or Cash Reserve Ratio.

When a bank's deposits boom by means of Rs100, and if the cash reserve ratio is 9%, the banks will ought to preserve Rs. 9 with RBI and the financial institution might be able to use most effective Rs 91 for investments and lending, credit motive. Therefore, higher the ratio, the lower is the quantity that banks will be able to use for lending and investment. This strength of Reserve bank of India to reduce the lendable amount by way of increasing the CRR, makes it an tool inside the fingers of a principal financial institution via which it could manage the amount that banks lend. Thus, it's far a tool used by RBI to control liquidity inside the banking system.

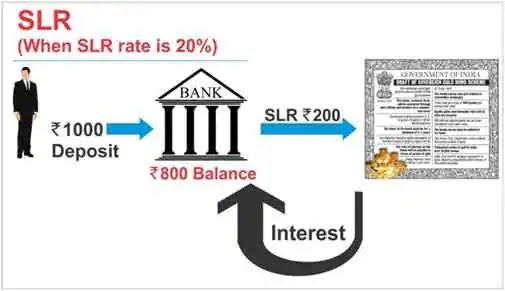

SLR - Statutory Liquidity Ratio - Every financial institution is needed to preserve on the near of business each day, a minimal share in their Net Demand and Time Liabilities as liquid belongings within the shape of cash, gold and un-encumbered approved securities. The ratio of liquid property to demand and time liabilities is known as Statutory Liquidity Ratio (SLR). RBI is empowered to increase this ratio up to forty%. An boom in SLR additionally restricts the bank's leverage role to pump extra money into the economic system.

Net Demand Liabilities - Bank money owed from which you could withdraw your money at any time like your financial savings bills and modern account.

Time Liabilities - Bank debts in which you can't right now withdraw your cash however need to wait for positive period. E.G. Fixed deposit money owed.

Call Rate - Inter bank borrowing price - Interest Rate paid with the aid of the banks for lending and borrowing finances with adulthood period ranging from sooner or later to 14 days. Call cash marketplace offers with extremely short time period lending among banks themselves. After Lehman Brothers went bankrupt Call Rate sky rocketed to such an insane degree that banks stopped lending to other banks.

MSF - Marginal Standing facility - It is a special window for banks to borrow from RBI towards accepted government securities in an emergency state of affairs like an acute cash shortage. MSF price is better then Repo rate. Current MSF Rate: 6.Seventy five%

Bank Rate - This is the long time charge(Repo charge is for quick time period) at which significant bank (RBI) lends money to other banks or financial establishments. Bank rate isn't utilized by RBI for financial management now. It is now identical as the MSF charge. Current bank price is 6.75%

No comments:

Post a Comment