The International Bank Account Number (IBAN) is an international standard for the identification of bank accounts across national borders to minimize the danger of transcription mistakes being propagated. It was initially adopted by the European Banking Standards Committee and was subsequently adopted under ISO 13616-1:2007 as an international standard. The formal IBAN registrar in accordance with ISO 13616-2:2007 is SWIFT The IBAN was initially created to promote payments within the European Union, but the format is flexible enough for global application.

It is a really significant piece of data that you will need whenever you make an global payment. The IBAN includes all the data that a bank or financial institution, such as Money Mover, requires to define the particular bank account you want to pay. It contains both a bank account number and the bank's own identification code. The structure is always consistent, but the length of the IBAN may vary depending on the account number format in the country where the account is held. Its length maximum is 34 characters.

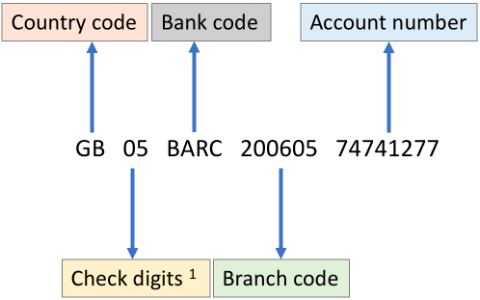

Here's a look at an IBAN for an account held in the UK:

- Country code for the country in which the bank account is kept is the two-character ISO code. These can be found here.

- The check digits are calculated from the data contained in the remainder of the IBAN number and the account and routing numbers are validated.

- The bank code defines the bank account holding institution. It's simple to work out in the first instance that it's Barclays. It is Banque CIC Sud Ouest in the second instance.

- The branch code defines the account holding particular branch of the bank. In the first instance, you will recognize the amount as a UK sort code. The code is the' code guichet' in the second instance.

- At the end of the IBAN, the account number itself is included.

No comments:

Post a Comment