Tuesday, June 25, 2019

Securities and Exchange Board of India (SEBI)

SEBI performs an critical function of regulating all of the gamers operating inside the Indian capital markets. It attempts to protect the interest of buyers and goals at developing the capital markets by way of enforcing numerous guidelines and guidelines.

1. What is SEBI

Securities and Exchange Board of India (SEBI) is a regulatory frame of the Government of India. It controls the securities market. It became hooked up on April 12, 1992 underneath the SEBI Act, 1992. It is centered on the Bandra Kurla Complex in Mumbai, India. It has local places of work in primary cities of India which includes New Delhi, Kolkata, Chennai and Ahmedabad. These cover the North, South, East and West regions of India. Besides, it has a network of neighborhood branch offices in prominent Indian cities.

2. Structure of SEBI

SEBI has a company framework comprising of numerous departments every controlled by means of a department head. Some of the departments are overseas portfolio traders, communications, human assets, collective funding schemes, commodity and derivative market regulation, legal affairs department, and so forth.

3. Functions of SEBI

The Preamble of the Securities and Exchange Board of India describes the simple functions of SEBI is the protection of traders pastimes in securities and to be a platform to sell, expand and alter the securities market in India as well as the bearing on topics which are related with it.

The securities exchange board is allowed to approve rules and legal guidelines pertaining to the inventory exchanges. It additionally implies that SEBI ought to put in force the legal guidelines for stock exchanges to observe. SEBI examines books of bills of monetary mediators and identified stock exchanges. Another position of SEBI is to urge respective corporations to list their shares in stock exchanges and control the registration of distributors/brokers.

4. Authority and Power of SEBI

The SEBI board has three main powers:

Quasi-judicial- In this, SEBI can deliver judgments related to the securities marketplace pertaining to fraud and other unethical practices. This helps to ensure equity, transparency, and accountability in the securities marketplace.

Quasi-legislative- These powers allow SEBI to frame regulations and regulations to shield pursuits if the buyers. Some of its policies consists of Insider Trading Regulations, Listing Obligation, and Disclosure Requirements and so on. These had been formulated to preserve malpractices at bay.

Quasi-government- SEBI is empowered to put in force its rules and to place up a case against violators. It is also authorized to look at books of accounts and different documents if it comes throughout any violation of the policies.

5. Mutual Fund Regulations by using SEBI

Some of the policies for mutual budget laid down by SEBI are:

(1) A sponsor of a mutual fund, an partner or a group employer which incorporates the asset control organisation of a fund, via the schemes of the mutual fund in any shape cannot preserve:

(a) 10% or more of the shareholding and balloting rights within the asset management employer or some other mutual fund

(b) An asset management business enterprise can't have a illustration on a board of another mutual fund

(2) A shareholder can't hold 10% or greater of the shareholding immediately or not directly inside the asset management business enterprise of a mutual fund

6. Mutual Funds and SEBI

According to SEBI suggestions, mutual finances must sign up as trusts below the Trusts Act, 1882. Then a company ought to be installation as a separate asset control enterprise (AMC) to run a mutual fund. The internet worth of the determine firm or AMC have to be Rs. 50,000,000. Mutual budget need to also sign up with the SEBI. There also exists a self-law company for mutual price range, Association of Mutual Funds of India (AMFI).

The Association of Mutual Funds in India (AMFI) is centered on growing the Indian Mutual Fund Industry with professional and moral traits. AMFI aims to decorate the standards in all areas for you to protect and sell mutual funds and the stakeholders.

Saturday, June 22, 2019

Wednesday, June 19, 2019

LITMUS examination

LITMUS examination platform is perfectly suited for web hosting in cloud environment. It is not unusual that in actual examination process greater wide variety of students accesses the system and gadget utilizes most processor and transactions for the duration of concurrent examination timing.This product is useful! for the institute,IT companies, schools, Universities,etc who want to conduct online exam for their student as per scheduling timings for various course/batch with own system and contents. We just provide link to conduction exams. Student can take exam via laptop. desktop. tablet or mobile.

In case of precise front examination that's to be conducted on-line for institute and around 50000 candidates are going to appear simultaneously, cloud computing can provide you choice to utilize most assets only in the course of actual examination system and ramp down utilization of hardware and resources after examination is finished. If online exam goes to be carried out for three hours then on-line exam device can be deployed in cloud environment like Microsoft Azure with autoscale facility for the digital machines. Auto scale facility of cloud environment enables to increase virtual machines routinely whilst extra customers are looking to get entry to the website.

In this way cloud environment permits maximum utilization of assets all through real on-line examination time and decreases or minimize the aid utilization when examination is completed. So any wide variety of applicants can appear for exam comfortably and cost related to infrastructure is minimum. Online examination might additionally provide you benefit of accurate consequences and analytics and other management , office work of guide exam management receives decreased appreciably.

Description

We provide just platform to be conduction online exam of enrolled students under any course or subject in a batch of any Institutes with branding Institute's name. All registered institutes can use this application for conducting online exam at any centre/batch as per scheduling time. We provide 2 panel for operating this application :-

1. Admin Panel : admin has to right to create batch/s. exam series. create question bank and student with limited controls and permission. Admin has authority to managing every thing inside the application like batch management. student management. exam series with section management. question bank management and many things will be explained in the Demo.

2. Co-Ordinator Panel : co-ordinator can register student and create a link for continue exam at particular time which set by admin.

3. Student Panel : student can appear for the mock and final exam. He can analyse the given examination correct,wrong unattempted,etc. He can read modules allocated him and give the related exam. He can view his/her details.

1. Test Series Management : In this module admin can create section/s as per test requirement. He can set limitation with each section (like number of question. marks per question and passing marks for a particular section). A validate exam can sent to any one via email withing exam scheduling timings. Any one can take it from any where by setting the permission in panel. Admin can take a print out of the exam like as offline exam. We provide rediment examination sheet on a click.

2. Question Bank Management :Admin can add question as per section wise in each test series either by adding one by one or import multi question from excel/word file. Each question has some tagging like difficulty level (easy. medium. difficult). Admin can set number of question as per test.

3. Batch Management : Admin is not bound to take test in a particular field while he is free to take a exam for various category like Engineering. Medical. Banking. SSC. Academics. GATE. IIT-JAM etc. After creating batch. admin schedule test series in a particular batch

4. Exam Management :As per requirement of Institutes. We create examination environment and our examination manager allow the following :- : Refreshing during live exam/test has no effect on reverse timer. : Student answer selection is fed into system in real time. : Student can change the chosen option (as per admin permission). • Unmark the selected option. : No effect of internet connection lost. : Back up is maintained on internet lost or electricity disconnection.

5. Some Other Benefits are as • Print facilities of student admit card (individual/batch wise) : Print facilities of any test for offline test : Set message and email permission for all steps. : Deeply student result reports. : Send notification to any student.

1. Admin Panel : admin has to right to create batch/s. exam series. create question bank and student with limited controls and permission. Admin has authority to managing every thing inside the application like batch management. student management. exam series with section management. question bank management and many things will be explained in the Demo.

2. Co-Ordinator Panel : co-ordinator can register student and create a link for continue exam at particular time which set by admin.

3. Student Panel : student can appear for the mock and final exam. He can analyse the given examination correct,wrong unattempted,etc. He can read modules allocated him and give the related exam. He can view his/her details.

Application Working

1. Test Series Management : In this module admin can create section/s as per test requirement. He can set limitation with each section (like number of question. marks per question and passing marks for a particular section). A validate exam can sent to any one via email withing exam scheduling timings. Any one can take it from any where by setting the permission in panel. Admin can take a print out of the exam like as offline exam. We provide rediment examination sheet on a click.

2. Question Bank Management :Admin can add question as per section wise in each test series either by adding one by one or import multi question from excel/word file. Each question has some tagging like difficulty level (easy. medium. difficult). Admin can set number of question as per test.

3. Batch Management : Admin is not bound to take test in a particular field while he is free to take a exam for various category like Engineering. Medical. Banking. SSC. Academics. GATE. IIT-JAM etc. After creating batch. admin schedule test series in a particular batch

4. Exam Management :As per requirement of Institutes. We create examination environment and our examination manager allow the following :- : Refreshing during live exam/test has no effect on reverse timer. : Student answer selection is fed into system in real time. : Student can change the chosen option (as per admin permission). • Unmark the selected option. : No effect of internet connection lost. : Back up is maintained on internet lost or electricity disconnection.

5. Some Other Benefits are as • Print facilities of student admit card (individual/batch wise) : Print facilities of any test for offline test : Set message and email permission for all steps. : Deeply student result reports. : Send notification to any student.

About LITMUS Exam

Online Examination Platform hosted on http://nectaropc.com is an Online Examination Platform proposed to many universities, Professional Training Institutes, Colleges to manage their Entrance Exams, internal assessments of the scholars. Currently extra than thousand exams were performed in this platform. It is cloud based platform with autoscale facility to control examinations of any scale.

Tuesday, June 18, 2019

Difference Between Swift Code And IFSC Code

Swift code and IFSC code are identification codes. These identifying codes are used by financial institutions, primarily banks, for the purpose of electronic money transfer. Which implies that when you transfer cash from one bank to another, you have to mention these codes. Swift code is used for global transfer of cash, while IFSC codes are needed for national transfer of cash i.e. transfer of cash within India from one bank to another.

SWIFT code

SWIFT code stands for the code 'Society for Worldwide Interbank Financial Telecommunication' A SWIFT code is a universal way for the worldwide identification of banks. The SWIFT code is an alphanumeric code of 8 or 11 characters that identifies financial institution uniquely. A SWIFT code's first four characters are letters and specifically refer to the bank. The country code is the next two characters, and the last two characters are the location code. If a SWIFT code is 11 characters, this implies that a three-digit code has been added by the bank to indicate a bank's particular branch.It is the normal Bank Identifier Codes (BIC) format that is approved by the International Standard Organization (ISO) and constitutes a specific branch of a bank or bank. The aim of these codes is to transfer cash between banks, particularly for global wire transfers, and to exchange other messages between banks.

IFSC code

IFSC is the Indian Financial System Code. If you're in India and want to move cash within the nation from one bank to another, you can do it readily once you understand both banks ' IFSC codes. IFSC needed you to use RTGS, NEFT or CEMS, which are various RBI-developed payment systems. IFSC is an 11 digit code The first four alphanumeric code characters reveal the bank's name. The fifth character was held zero in order to accommodate branch development. The last six characters in the code tell the bank's precise place. The IFSC code is even printed on the check books published by all banks and by looking at the check slip you can understand the IFSC code.

Difference Between Swift Code And IFSC Code

- Swift Code Stands for ‘Society for Worldwide Interbank Financial Telecommunication’ whereas IFSC stands for ‘‘Indian Financial System Code’

- SWIFT code is for international cash transfer at the same time as IFSC code is used for home cash transfer (within India)

- SWIFT code has been developed with the aid of International Standard Organization (ISO) even as IFSC code has been advanced by Reserve Bank Of India (RBI)

- SWIFT code has 8 or 11 characters even as IFSC codes contain eleven characters

Difference Between Swift Code And IBAN Code

To process transactions there quickly and precisely, banks and financial institutions use distinct identification numbers. Account number is one illustration of this type of identity number that enables both the bank and the account holder to perform and process each bank transaction. Likewise, the transfer of funds is one method that requires some kind of identification for banks to make quicker and more precise transactions between distinct banks around the world (Global Fund Transfer).

Earlier banking transactions were restricted to one bank or nation, but global transactions are rising over time, which requires some type of clear identification to ensure that your transaction takes place properly and in time. Swift Code and IBAN (International Bank Account Number) code are identification codes used by banks and financial institutions to make international bank accounts simple to identify.

IBAN Code

As the name suggests, IBAN (International Bank Account Number) is an international identification number that is the extension of your existing bank account number that can be internationally recognized. IBAN can be used to create global payments as it makes global transactions simpler and quicker. Developed by ISO (International Organization for Standardization), it is an international standard for defining global bank accounts with minimal danger of transcription mistakes.

In Simple Worlds, you can quickly get IBAN number from your bank and make global wire transfer of cash if you have someone in a foreign country to whom you want to make payment. IBAN involves country code, check numbers (Can be validated by a single normal operation in any country), bank account number, etc., which shows all the required data.

SWIFT Code

SWIFT code stands for the code ' Interbank Financial Telecommunication Society for Worldwide.' A SWIFT code is a universal way for the worldwide identification of banks. The SWIFT code is an alphanumeric code of 8 or 11 characters that identifies financial institution uniquely. A SWIFT code's first four characters are letters and specifically refer to the bank. The country code is the next two characters, and the last two characters are the location code. If a SWIFT code is 11 characters, this implies that a three-digit code has been added by the bank to indicate a bank's particular branch.

It is the normal Bank Identifier Codes (BIC) format that is approved by the International Standard Organization (ISO) and constitutes a specific branch of a bank or bank. The aim of these codes is to transfer cash between banks, particularly for global wire transfers, and to exchange other messages between banks.

Difference Between IBAN Code And Swift Code

- SWIFT code is used to identify a bank while IBAN is the International Bank Account Number.

- Customers use IBAN to ship cash to other countries while banks use SWIFT to exchange economic and non-financial transactions.

What is IBAN & required to transfer fund from foreign to India ?

The International Bank Account Number (IBAN) is an international standard for the identification of bank accounts across national borders to minimize the danger of transcription mistakes being propagated. It was initially adopted by the European Banking Standards Committee and was subsequently adopted under ISO 13616-1:2007 as an international standard. The formal IBAN registrar in accordance with ISO 13616-2:2007 is SWIFT The IBAN was initially created to promote payments within the European Union, but the format is flexible enough for global application.

It is a really significant piece of data that you will need whenever you make an global payment. The IBAN includes all the data that a bank or financial institution, such as Money Mover, requires to define the particular bank account you want to pay. It contains both a bank account number and the bank's own identification code. The structure is always consistent, but the length of the IBAN may vary depending on the account number format in the country where the account is held. Its length maximum is 34 characters.

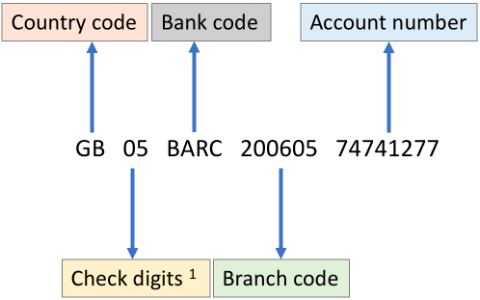

Here's a look at an IBAN for an account held in the UK:

- Country code for the country in which the bank account is kept is the two-character ISO code. These can be found here.

- The check digits are calculated from the data contained in the remainder of the IBAN number and the account and routing numbers are validated.

- The bank code defines the bank account holding institution. It's simple to work out in the first instance that it's Barclays. It is Banque CIC Sud Ouest in the second instance.

- The branch code defines the account holding particular branch of the bank. In the first instance, you will recognize the amount as a UK sort code. The code is the' code guichet' in the second instance.

- At the end of the IBAN, the account number itself is included.

Thursday, June 13, 2019

Wednesday, June 12, 2019

Monday, June 10, 2019

Types of Financial Market

Based on market major categories

- Primary market: Primary marketplace is a marketplace for new issues or new economic claims. Hence it’s additionally known as new trouble marketplace. The primary market deals with those securities which are issued to the general public for the primary time.

- Secondary marketplace: A marketplace for secondary sale of securities. In different words, securities that have already handed via the new problem market are traded on this market. Generally, such securities are quoted within the stock change and it affords a continuous and normal market for buying and selling of securities.

Simply positioned, primary market is the market where the newly started agency issued stocks to the public for the primary time through IPO (initial public offering). Secondary marketplace is the market in which the second one hand securities are sold (security Commodity Markets).

Based on security types

- Money market: Money marketplace is a market for dealing with the financial property and securities that have a maturity period of as much as 365 days. In different words, it’s a market for in basic terms short-time period finances.

- Capital marketplace: A capital market is a marketplace for economic assets that have a long or indefinite maturity. Generally, it deals with lengthy-time period securities which have a maturity length of above three hundred and sixty five days. The capital market can be further divided into (a) industrial securities marketplace (b) Govt. Securities marketplace and (c) long-time period loans marketplace.

- Equity markets: A marketplace wherein possession of securities are issued and subscribed is known as fairness marketplace. An example of a secondary equity marketplace for shares is the National Stock Exchange (NSE) stock trade.

- Debt marketplace: The marketplace in which budget are borrowed and lent is called debt marketplace. Arrangements are made in this type of manner that the borrowers comply with pay the lender the authentic amount of the mortgage plus some exact quantity of interest.

- Derivative markets: A marketplace where economic instruments are derived and traded based totally on an underlying asset consisting of commodities or shares.

- Financial carrier marketplace: A market that incorporates contributors along with industrial banks that provide diverse financial services like ATM. Credit cards. Credit score, stock broker and so forth. Is referred to as financial provider marketplace. Individuals and corporations use financial services markets, to buy offerings that decorate the workings of debt and fairness markets.

- Depository markets: A depository marketplace includes depository establishments (which includes banks) that receive deposits from people and corporations and uses these finances to take part inside the debt market, by way of giving loans or purchasing other debt instruments including treasury bills.

- Non-depository marketplace: Non-depository market perform diverse functions in monetary markets starting from monetary intermediary to selling, insurance and many others. The numerous constituencies in non-depositary markets are mutual finances, insurance organizations, pension funds, brokerage corporations and so on.

Financial Market

A financial market is a financial goods marketplace. Buyers and vendors are interacting with each other here. They trade in economic resources such as equity, bonds, mutual funds, currencies, and derivatives. The price discovery of such economic resources is solely the demand and supply play of the market's fundamental resources. The financial market therefore functions as a bridge between those who have access to cash with those who are in deficit and need cash. Thus, flows from providers to request funds through financial market funds through the use of financial instruments. Let's now look at the various kinds of financial markets and their short role.

Functions of financial markets

- Intermediate features: Financial markets ' intermediate functions include: resource transfer: financial markets facilitate the transfer of actual economic assets from lenders to ultimate borrowers.

- Revenue enhancement: Financial markets enable lenders to gain interest or dividend on their surplus invisible resources, thus contributing to person and national income improvement.

- Productive use: Financial markets enable the borrowed funds to be used productively. The improvement of revenue and gross domestic output.

- Capital formation: Financial markets provide a channel by which fresh savings flow to support a country's capital formation.

- Pricing: Financial markets enable the price of traded economic resources to be determined through buyers and sellers interaction. Through the system called price discovery process, they provide a sign for allocating resources in the economy based on demand and supply.

- Sale mechanism: Financial markets provide a mechanism for an investor to sell a financial asset to provide marketability and liquidity benefits for such investments.

- Information: The economic market participants ' operations result in the generation and consequent dissemination of data to the different market segments.To decrease economic asset transaction costs.

Financial functions

- Providing resources to the borrower to allow them to implement their investment plans.

- Providing earned assets to lenders in order to allow them to gain wealth by deploying assets in debentures for manufacturing.

- Providing market liquidity to enable fund trading.

- Facilitation of credit creation Promoting savings Promoting investment Facilitating balanced economic growth Improving trade floors

Sunday, June 9, 2019

What is Currency

Currency relates to any kind of cash that is in circulation in an economy used to buy products and services. Most frequently, the term currency can refer to any type of cash that is used throughout the public in circulation. Currency today generally includes both coins (tough cash) and paper (soft cash).

It is usually issued and retained by a governing body and is known as money ' fiat.' This implies the currency's value does not come from the material from which it is produced, but from the value it represents depending on the economy and the issuer.

Why currency is important

It also establishes a standard of value apart from the apparent benefits of currency as a basis for trade (purchasing and selling), enabling trade to work more smoothly than through bartering.

Currency is also regarded as a value shop. This implies that, while maintaining most, if not all of its value, it can be stored and carried out later.

Types of currency

There are a few other kinds of currency, both contemporary and antiquated, apart from the physical currency used by nations controlled by a governing body.

- Digital currency You've likely already heard about bitcoins. Digital currency is the latest monetary form available today. Also this currency is virtual-meaning it has no physical shape. All transactions take place online.

- Asset-backed currency An asset-backed currency implies that a specific resource or asset is linked to the currency. For instance, it can be a precious metal like gold. An asset-backed currency is then secured, and an amount of the asset can also be exchanged.This sort of currency may be somewhat volatile as it depends on the value of the asset.

- Commodity-backed currency This currency form is somewhat old-fashioned and is no longer in use today. Like asset-backed currency, such as wheat or oil, this form is linked to a commodity. However, owing to market fluctuations, it was mainly unreliable.

Saturday, June 8, 2019

Save or Invest

Saving is the method of parking tough coins in extraordinarily secure and liquid securities. The primary intention need to be capital upkeep and the secondary goal getting some returns, if possible. This can include financial savings debts and certificate of deposits among others.

Investing is the process of the use of money/capital to generate a secure and appropriate return over a time-length. An investment can encompass actual property, gold coins, stocks, mutual budget and small enterprise to call a few.

Differentiate among saving and investment

Saving

- Savings are preferably smaller, for short-term dreams within the close to future like a holiday, emergency and many others.

- Liquidity is excessive, giving prepared access to coins whilst needed.

- There is generally no chance involved.

- You can earn interest to your savings.

Investment

- Investments involve setting cash to paintings to create wealth for reaching long-term desires like baby’s education, house and so on..

- Liquidity is usually not smooth when you invest money.

- Risk concerned is commonly high.

- Investments have a capability to yield better returns, where investments appreciate over time.

How a good deal ought to one Saving and invest?

Savings is the muse to build your economic dreams. Savings will provide you the capital to layout your investments. The fundamentals that preferably want to be accompanied are:

- As a thumb rule, your savings have to be enough to cowl private expenses like mortgage bills, insurance, software payments and so on. And any unforeseen fees.

- Any particular purpose to be able to require a large corpus of fund in 5 – ten years need to be investment driven. For eg. Shopping a domestic after say 5 years will require a consistent investment goal these days.

Define your dreams

- While saving, your number one aim is to secure your cash without dropping any of its value. Though saving cash preserves its nominal cost, it’s opportunities to develop are confined.

- While making an investment, you provide your assets the potential to develop over a time-length. Typically, you re-make investments your interest, dividends and other capital profits. More regularly than now not you are willing to take dangers whilst investing your money. But with the appreciation in cash, also comes the chance of dropping cash. Hence, keeping an extended time-frame is commonly encouraged to recover from any decrease in value.

Explore options

- Savings bills

- Money marketplace bills

- Certificate of deposits (CDs)

- bonds

There are a bunch of investment alternatives as properly:

- Individual Securities together with shares and bonds

- Pooled investments such as mutual funds

- Real Estate

- Gold

Foreign Exchange

Foreign Exchange, the Forex market (FX) as it is generally called, is buying and selling of a single currency for any other at a certain fee. It truly manner shopping for one forex and promoting the other. The values recognize and depreciate due to various monetary and geo-political elements. The goal of FX trader is to make earnings from those fluctuations in prices, speculating on which way the forex fees are in all likelihood to transport in the destiny.

Currency buying and selling markets are available 24-hrs a day, five days per week, Saturday and Sunday being vacations. Forex transactions are generally quoted in pairs because when one foreign money is offered, the opposite is sold. The first forex is referred to as the ‘base currency’ and the second one foreign money referred to as the ‘quote currency’.

What is the spot market?

The spot market is where currencies are purchased and sold at the present cost. This price, determined by supply and demand, reflects many stuff, including present interest rates, financial performance, a sense of continuing political circumstances, as well as a perception of the future performance of one currency against another. It is a bilateral transaction through which one individual provides the counter individual with an agreed currency quantity and gets a defined quantity of another currency at the agreed exchange rate value. The settlement is in money after a position has been closed. Although the spot market is frequently referred to as one dealing with current operations, these transactions actually take two days to settle.

What is Forwards and Futures markets?

The markets for the future and forwards do not trade real currencies. They deal with agreements representing claims to a certain sort of currency, a particular price per unit, and a settlement date in the future. OTC agreements are purchased and sold in the forward market between two people, who determine the conditions of the contract among themselves.

In the futures market, Futures contracts are purchased and sold on government commodity markets, such as the Chicago Mercantile Exchange, depending on normal size and settlement date. The National Futures Association is regulating the futures market in the United States.Future contracts have specific details, including the number of units traded, the dates of delivery and settlement, and the minimum price increases that can not be tailored. The exchange provides clearance and settlement as a counterpart to the trader.

Forex Trading is the same as equity trading. Share issues in equity trading while exchange rate issues in forex trading. You can purchase or sell currency pairs according to your monetary motion expectations. For a better comprehension, please refer to the instance below.

Currency buying and selling markets are available 24-hrs a day, five days per week, Saturday and Sunday being vacations. Forex transactions are generally quoted in pairs because when one foreign money is offered, the opposite is sold. The first forex is referred to as the ‘base currency’ and the second one foreign money referred to as the ‘quote currency’.

What is the spot market?

The spot market is where currencies are purchased and sold at the present cost. This price, determined by supply and demand, reflects many stuff, including present interest rates, financial performance, a sense of continuing political circumstances, as well as a perception of the future performance of one currency against another. It is a bilateral transaction through which one individual provides the counter individual with an agreed currency quantity and gets a defined quantity of another currency at the agreed exchange rate value. The settlement is in money after a position has been closed. Although the spot market is frequently referred to as one dealing with current operations, these transactions actually take two days to settle.

What is Forwards and Futures markets?

The markets for the future and forwards do not trade real currencies. They deal with agreements representing claims to a certain sort of currency, a particular price per unit, and a settlement date in the future. OTC agreements are purchased and sold in the forward market between two people, who determine the conditions of the contract among themselves.

In the futures market, Futures contracts are purchased and sold on government commodity markets, such as the Chicago Mercantile Exchange, depending on normal size and settlement date. The National Futures Association is regulating the futures market in the United States.Future contracts have specific details, including the number of units traded, the dates of delivery and settlement, and the minimum price increases that can not be tailored. The exchange provides clearance and settlement as a counterpart to the trader.

Forex Trading is the same as equity trading. Share issues in equity trading while exchange rate issues in forex trading. You can purchase or sell currency pairs according to your monetary motion expectations. For a better comprehension, please refer to the instance below.

- Assume you'd like to take benefit of a dollar's rising cost. The dollar is trading at Rs 64, you feel the price will appreciate and you expect to achieve Rs 67 in a few months by purchasing a USD/INR swap agreement. You get the profit of Rs.3 per dollar if the price comes to Rs 67. So you can receive Rs.3000 in the single $1000 contract.

- If you see that Rupee is appreciating and dollar prices are anticipated at Rs 63 after joining the agreement, you can' shortly close' your place by selling future contract currency. If the dollar value gets to Rs 63, by squaring off your position, you can earn Rs 1 per dollar. Total profit will be Rs.1000 on a $1,000 agreement. However, you lose Rs 2 per dollar if a dollar goes up and reaches Rs 67. During the contract period, an investor can square off stance at any time.

Commonly traded currencies

Currencies are indicated through three letter symbols. The widespread symbols for some of the maximum traded currencies are:

- EUR – Euros

- USD – United States Dollar

- CAD – Canadian Dollar

- GBP – British Pound

- JPY – Japanese Yen

- AUD – Australian Dollar

- CHF – Swiss Franc

Tuesday, June 4, 2019

Understand Risk and Return Tradeoff

Higher risk associated with higher yield probability and decrease threat related to a better probability of reduced yield. This alternate off that an investor faces among hazard and go back even as considering investment picks is called off threat return change.

All investments convey a few degree of threat. The rule of thumb is “the better the threat, the higher the potential return,” however you need to bear in mind an addition to the guideline so that it states the relationship greater absolutely: “the better the chance, the higher the ability go back, and the much less probable it's going to acquire the higher return.”

To apprehend this dating absolutely, you have to understand where your comfort degree is and have the ability to correctly gauge the relative danger of a specific stock or different funding.

When you choose to position your cash into investments that involve a better degree of chance than a general savings or cash market deposit account, you run the opportunity of experiencing any or all the following to a few diploma:

- Losing your predominant: person shares or high-yield bonds should cause you to lose everything.

- Not retaining tempo with inflation: your investments may want to upward push in cost slower than costs. Especially probably in case you're invested in coins equivalents, Treasury or municipal bonds.

- Coming up brief: Your investments may not earn sufficient to cover your retirement wishes. Possible in case you're invested in cash equivalents, Treasury or municipal bonds.

- Paying high costs or different prices: Expensive charges on mutual price range can make it tough to make a terrific return. Beware of actively-managed mutual funds or ones with income loads.

BREAKING DOWN Risk-Return Tradeoff

Risk-Return Tradeoff is the trading principle that combines high risk with elevated reward. The suitable risk-return trading relies on a multitude of variables including the risk tolerance of an investor, the pension years of the investor, and the ability to substitute lost resources. Time also plays a key role in determining a portfolio with the suitable risk and reward levels. For example, if an investor has the ability to invest in long-term equities, which gives the investor the potential to recover from the risks of bear markets and participate in bull markets, while an investor can only invest in a short timeframe,That offers an investor with the ability to recover from bear market hazards and engage in bull markets, while where an investor can only invest in a short time frame, the same equities have a greater risk proposal.

Investors use risk-return trading as one of the key parts of each investment decision, as well as evaluating their portfolios as a whole. The risk-return tradeoff at portfolio level can include evaluations of the concentration or variety of stocks and whether the mix poses too much risk or a lower-than-desired return potential.

What is Mutual Fund and Types of Mutual Funds

A mutual fund is an equity pooling entity managed by an asset management company (AMC) professionally. It takes a group of investors together and invests their cash in stocks, bonds and other avenues. You are allocated mutual fund units as a mutual fund investor that show your contribution to a specific plan. At the prevailing net asset value (NAV) of the fund, you can buy or redeem these units as needed.

Usually, a mutual fund's NAV shifts every day depending on the fund's underlying resources. Mutual funds are secure investment havens as they are registered and operated in compulsory compliance with SEBI regulations. The primary advantage of investing through a mutual fund is that at a comparatively tiny quantity of investment you get access to skilled fund management and diverse portfolios.

Mutual fund types can be classified based on the following characteristics.

Based on Asset Class

- Equity Funds

- Debt Funds

- Money Market Funds

- Hybrid Funds

Based on Structure

- Open-ended Funds

- Closed-ended Funds

- Interval Funds

Based on Investment Goals

- Growth Funds

- Income Funds

- Liquid Funds

- Tax-Saving Funds

Based on Risk

- Very Low-Risk Funds

- Low-Risk Funds

- Medium Risk Funds

- High-Risk Funds

Specialized Mutual Funds

Monday, June 3, 2019

What is Share and Types of Shares

A share definition includes a company's capital or stock. Each company has a requirement for share capital. A share is a single unit within the company's entire capital. A share is a kind of security as well. Their liability and interest often measure it. Members who own a company's shares are called shareholders. They are investors who have invested money in the company. They will receive dividends on the company's profits in return. You can be a common shareholder or preferred shareholder based on ownership when you purchase a share.

Common Shareholder: You are allowed to vote at shareholder meetings as a common shareholder and you are eligible for dividends. If the company you have invested goes bankrupt, only after all creditors and preferred shareholders have been paid will you receive the share of the liquidation proceeds.

Preferred Shareholder: You might not have voting rights as a preferred shareholder. But you will receive dividends before it is received by the common shareholder.

Types of Shares

- Preference stocks: Preference shares have preferential rights to dividends if a business closes. Preference shares do not have voting rights available, besides in specific situations.

- Equity shares: Equity stocks do now not have preferential rights. Instead, they receive payment from dividends and compensation of capital after choice shares' claims were settled. The precise rate of return is determined via the board members and administrators. Equity shareholders are often owners of the enterprise and have everyday voting rights available. They can also be problem to things like deferred shares or founder's stocks.

- Cumulative choice proportion: A cumulative choice shareholder does not receive price whilst a income isn't always made. However, cumulative shares can be paid via unpaid dividends. A cumulative desire shareholder is handiest paid after other shareholders have been paid. If no finances remain, then they may now not receive a price that yr.

- Non-cumulative choice stocks: Non-cumulative choice shareholders have preferential shareholder rights and receive a set dividend fee. However, they are simplest paid if income stay. If no income left, the owed amount isn't always carried over to the following years.

- Redeemable choice shares: Any capital amassed from selling stocks isn't always paid to a shareholder. But, any capital raised through desire shares can be paid to the shareholder on the quit of the duration. There can be time limits on these redeemable stocks, which from time to time exceed 10 years or more.

- Participating/Non-collaborating preference shares: These shares are paid through a mixture of profits and fixed prices. Once all profits were paid to shareholders, any extra money is split equally amongst those shareholders.

- Convertible preference shares: Convertible choice stocks can be converted into equity stocks at a preset time. All conversions ought to be permitted based on the regulations set in the organisation Articles of Incorporation.

Saving v/s Investing

Saving

We save for shopping and emergencies. For things that need a vehicle to sit in, we save when we need them and have a low risk of losing value. Tracking your savings, setting a deadline or timeline to your goals, and setting a value is important. Savings is the quantity of money left over after spending from disposable earnings (DPI). Savings discuss with cash you placed apart for destiny use as opposed to spending it at once. Savings are performed for sudden monetary emergencies. Money can also be stored to purchase costly objects which might be too high priced to buy with monthly profits. Buying a brand new digital camera, purchasing an car, or deciding to buy a vacation can all be achieved through saving a portion of profits. There are several ways thru which a person can save cash like, accumulating it in the shape of coins holdings, or depositing it into the financial savings account, pension account or in any investment fund.

We keep for purchases and emergencies. We keep for things that need a automobile to sit down in, to be had while we want them and have low hazard of dropping price. It is crucial to tune your financial savings, placed a closing date or timeline in your desires and a value. For instance, in case you are saving for your annual family excursion, you would possibly want to target $3,000 to shop in 9 months, to withdrawal in December. You then realize how plenty you want, how a good deal to save monthly and the ability to take the cash, with out price to spend on that valuable excursion.

Investing

An investment is an asset or item received with the goal of generating income or appreciation. It is the procedure of the use of your money or capital, to buy an asset which you suppose has a great probability of producing a safe and suitable price of go back over the years. Investments may be stocks, bonds, mutual finances and, derivatives, actual estate; earrings whatever an investor believes will produce profits usually inside the shape of hobby or rents. It is important not only to invest, but also to invest wisely when investing. When you invest early, you'll get a better return. To be successful, it will be imperative to understand different investment vehicles, what they are for and how to use them.

When investing, it is crucial no longer simply to make investments, but make investments wisely. You will have a higher go back when you make investments early. Understanding one-of-a-kind funding cars, what they may be for and how to use them could be vital to being successful. We make investments long term, for our children’s college fund or retirement. These permit for withdrawals whilst your toddler goes to university. Long-term university plans, like the ones reviewed in this text, permit you to to direct that intention, successfully.

Key differences between Saving and Investing

Savings Vs Investing Savings are typically about 1-3 years to achieve small financial goals in short periods of time! If you're looking forward to buying a mobile phone or going on a small domestic holiday in the near future, saving may be a good option for achieving these goals. Investing, on the other hand, is typically a long-term plan for larger financial objectives. Say you're planning for your child's upbringing or wedding, or your comfortable retired life that's due in about 5 years or more from now, investing from now on can make those goals attainable when needed.

Access of Money

When money savings are critically needed, they serve as handy cash. You've got all the savings access to your money. You may withdraw some or all of your savings as you wish, but sometimes you end up spending money to which you have easy access. Access to your money in the event of an investment depends on the type of investment you make. Open ended schemes of mutual funds equity allow you to redeem your investments whenever possible. If the investment period is more than one year in the equity mutual fund scheme, the capital gain will be exempted from tax liabilities. The Indian government also provides a tax rebate for equity-related saving schemes (ELSS) u / s 80C of the 1961 Income Tax Act.

Risk

If you save in reputable banks, your money in bank accounts is safer than at home. Compared to any investment, the risk of losing money in savings is therefore very low. Besides this, you also have the right to interest in your savings. Investing media may involve the risk of potential returns related to the investment term or market situations. Investment in the equity market entails an inherent risk. If you don't invest in quality stocks with long-term growth potential companies, you might lose money. It is therefore advisable to use expert financial advisors ' services. Investment risk varies depending on investment channels.If your money is invested in long-term good-quality businesses, short-term ups and downs should not affect your outlook for such investments. Mutual fund provides details of the scheme thus indicating the potential risk involved. Investing wisely can yield far higher returns than long-term savings.

Returns

Return on savings, return on investment In the event that you invest in bank deposits, you can earn interest on average up to about 8-9 %. There is often a much lower interest in savings accounts. Investments in mutual fund schemes based on equity, however, have much higher potential for long-term value growth. Investments in quality have higher potential returns than regular savings compared to approximately 5-10 years in the long term.

Choice

Identify your purpose first is the right thing. Why do you want your money to be saved or invested? Check for short-term or long-term goals. Saving money for short-term goals, emergencies and casual expenses is always wise as it provides fast access. This makes meeting small goals easier. But consider your changing needs, limited sources of income, and inflation in the long run; savings may be short for larger financial goals. Remember that you are planning ahead. Starting investing at a young age is advisable, but it is never too late.Savings are for the present and future investments. Typically, investments are made for larger financial goals that may now seem impossible but would be possible in the time to come if they are planned wisely today. Smart investment is the key to achieving these goals. To conclude, inflation rates do not follow your dreams. Saving for short-term goals is recommended, but investing at the same time can make it easier to achieve your long-term dreams.

Sunday, June 2, 2019

Financial Planning - Need of Financial Planner

Benefits of Using a Financial Planner

Full-Time Expert

A monetary consultant who is a full-time expert will provide you a wealth of education, expertise, qualifications and enjoy this is hard or not possible to gain yourself. It’s always top to take the effort to make certain you're as informed as feasible however for a economic guide, this is their job.

On pinnacle of that, a economic guide will have years or even a long time of experience working with and for different professionals inside the world of funding and financial management. A suitable financial guide is one that comes recommended through phrase of mouth. That enjoy and referral is regularly tough-gained and it may be not possible to vicinity a value on it.

Taxation

There is little factor in putting your money into an funding, most effective to discover that the vagaries of taxation imply every other possibility that had looked much less appealing would have been extra effective. In different instances, taxation can erode the gains generated by using an funding. Sometimes, in case you’re no longer careful, an funding that regarded best can bring about a tax fee that hurts your usual private profits, occasionally arriving at exactly the incorrect second.

A economic advisor can take care of exactly these worries, ensuring that all viable tax implications had been taken into consideration earlier than going in advance with an funding. They can also help to maintain aware about methods to lessen your standard tax burden, advising you of the modern-day relevant adjustments to law or the launches of latest investments that offer lengthy-time period gains, as well as tax efficiency.

Research

A financial advisor spends a lot of his or her time on research. When thinking about your particular investment needs, they may studies the nice opportunities. If they don’t already have the answers to any questions you may have right away handy, they will set up the proper answers.

More typically, a economic advisor will undertake research on a ordinary basis a good way to make certain they maximize their information of the industry, markets, law and taxation — so you don’t should. They will frequently be assisted with the aid of other advisors, analysts, and industry professionals, all assisting to bolster the consultant’s very own research.

Relaxation

Perhaps one gain, more so than some other, is furnished by using a monetary guide: the risk for rest. Having discovered the proper economic advisor, you could properly relax, safe inside the know-how that an funding expert is looking after a wide range of challenges and questions which you could in any other case must cope with.

You have extra time for yourself because you don’t have to keep tabs on the market so intently. The investment advisor does that activity and could contact if there's whatever you need to speak about. And in case you do have any questions or issues, you know you may effortlessly contact the financial advisor, to get solutions in a timely way.

Some more Benefits as follows:

- Ensuring your cash will last amid retirement or moving over a retirement plan

- Dealing with the legacy of a huge aggregate of cash

- Planning for a marriage or separation

- Making arrangements for the birth or reception of a youngster

- Confronting a money related emergency

Importance of Financial Planning

1. Determine your present day financial state of affairs

2. Develop your economic desires

3. Identify opportunity courses of movement

4. Evaluate alternatives

5. Create your Financial Action Plan and implement it.

6. Review and revise the financial plan

Importance of Financial Planning

Inflation

Future Financial Planning Inflation Benefits is called the largest purchasing power destroyer. In the Indian context, if calculated in 1979 with the factual figures price of Rs. 100, this year as on (September 2015) is Rs. 5.55 and will go further down. It's a fall in money value. This is because demand is growing more rapidly than supply, leading to a price hike. Considering the current times and the expected changes in the future, this may continue. Today is the day one should be actively planning finances to sustain inflation in the future. Financial planning ensures that you maintain inflation while remaining unaffected by your goals.

Long - Term Goals

Long - Term Goals

The creation of long-term wealth, financial planning Some milestones in life are very important. Whether it's a family car, your own home, the education of your children or their marriage; fulfilling these needs is a responsibility. Financial planning is a process of drawing up a proper financial plan in a specific period of time to meet your financial goals. Planning early is better as investment options can earn high returns over time. Investing your money from now on will make such long-term goals easier to achieve.

Emergencies

Prevention is better than cure, and getting ready is better than regret when it comes to money. Before your goals, there may be inevitable and unexpected times that may become hurdles. Financial planning means being prepared for such situations without affecting primary goals. Providing your family with security is an important part of financial planning.

Dreams

Financial planning is a step in your dreams. You might have been thinking with your family about a foreign trip, an independent house, or living a dream. May the dreams never disappear because of responsibilities! Financial planning supports your dreams while performing your duties.

Retirement

While meeting your family goals, having a comfortable retired life is a general goal. If after more than 10 years you are planning a retirement, you should plan to invest from now on because the magic of compounding is experienced if it remains invested for a long time. Financial planning helps you create an adequate retirement corpus when expenditures continue but income appears to dry. Considering investing for the goals of your life is advisable. Plan for a better future today.

Subscribe to:

Comments (Atom)